Photo by Ikhsan Assidiqie on Unsplash

Just a little over a decade ago, almost 4 in 5 Southeast Asians did not have accessible internet. Today, there are over 360 million internet users in Southeast Asia (SEA)— with 90% that are connected to the internet primarily through their mobile phones.

Moreover, the rise of internet usage has spurred the internet economy and tripled in the last 3 years, hitting USD$100 billion for the first time in 2019. Internet economies in Malaysia, Thailand, Singapore, and the Philippines are currently growing at 20–30% annually while our initial target markets, Indonesia and Vietnam, has led growth in SEA at an excess of 40% annually!

According to Google’s e-Conomy SEA 2019 report, digital payments in SEA are even expected to hit USD$1 trillion by 2025!

BUT…

Digital wallets and payments have been stagnant at a penetration rate of only 6–7% despite seeing huge growth in the internet economy. The adoption of digital payments has not taken off and is not consumer-friendly at all.

As an example, we all might have had the luxury of purchasing movie tickets online which usually takes 5 steps or even lesser to complete a transaction.

However, in emerging markets like Indonesia where digital payments have not taken off, the process to purchase movie tickets online is a long, painful and tedious process. To put this into perspective, here is the process breakdown for making a movie ticket purchase online in Indonesia:

- Bob selects his preferred seat, timing and movie on the online platform

- Bob is prompted to send a transaction via Internet Banking within 3 to 5 minutes

- Bob logs into his Internet Banking account and is prompted to key in his OTP by his bank as a security measure

- Bob navigates to the transaction page, keys in the details provided by the online platform to add them as a payee and waits for OTP again

- Bob finally makes payment for his movie tickets

- Transaction invoice is given to Bob and he has to input it onto the online platform before the stipulated time

- Purchase is finally done and the booking ID is sent to Bob’s email for the printing of the tickets onsite

Hopefully, you get the idea and feel as annoyed as I am listing down the steps… In addition to this tediousness, Bob runs the risk of having his preferred seats taken away if he does not complete his transaction within the stipulated time!

So what is causing these inefficiencies in emerging markets when the majority of us can make such purchases with ease?

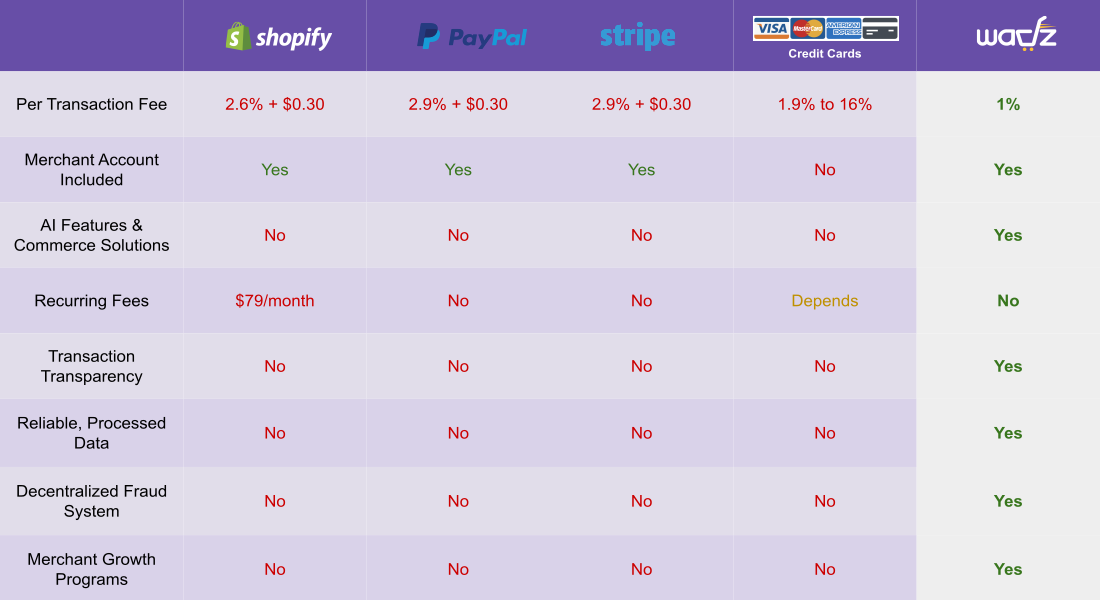

High Cost and Transaction Fees

Have you ever wondered why there is a minimum purchase amount before you can make cashless payments with certain businesses?

Well, consumers may make payments digitally at no additional cost but merchants usually have to bear the cost of the transaction and/or processing fees when using conventional payment processing technologies.

As we move towards a cashless economy, most merchants outside of emerging markets have to keep up with consumer trends and are essentially forced to implement expensive, outdated payment technology into their business processes. Merchants are required to deploy dedicated check-out lanes or hardware to fully utilize them as well.

Low Income, Low Spending Power, Long Settlement Period

Picture yourself owning a fresh vegetables and fruits store in a village of 2000 people in rural Indonesia where the average income is low —several factors might prevent you from adopting conventional digital payments processing technology.

- Low income also means low spending power, which does not make sense for you to adopt conventional digital payments processing technology when there are fees involved for every transaction.

- You have a low-profit margin to fit the income range of the villagers as well as to get rid of your perishables before expiry.

- After making a digital transaction, there is a long settlement period before the money is yours. With a low-profit margin, chances are you barely make ends meet and cannot afford to wait too long for the sake of your livelihood. And lastly…

Around 50% of Indonesians & Vietnamese are Currently Unbanked

In small rural villages, a large majority simply do not even have a bank account to start utilizing digital payments — merchants just do not see the need to implement cashless solutions.

Many of these folks remain unbanked because of the following:

- lack of trust towards the banks

- documentation requirements

- cost of maintenance

- distance barriers

- limited earnings.

So, how do we solve these issues at hand and start increasing digital payment penetration in emerging markets?

I will be releasing a blog series on how Wadz will solve these issues at hand soon, so if you are interested pleasestay up to date by joining our telegram channel here: https://t.me/wadzcommunity

If you can’t wait any longer and wish to learn more, please check out our whitepaper here or for a summary check out our overview page here

About Wadz (https://wadz.com)

Wadz is a blockchain-based, inclusive application that is set to redefine the payment processing industry and incentivize data ownership for both consumers and businesses. Wadz strives for the minimization of malicious activities, and maximization of positive contributions through its unique Proof-of-Contribution (PoC) governance protocol.

Find out more about Wadz’s latest developments!

Telegram

Telegram Announcement

Twitter

LinkedIn

Facebook

Instagram